Economic uncertainty suggests market volatility may be on the horizon, and that means it could be a good time to focus your investing on high-quality companies rather than more speculative growth plays. The Dow Jones Industrial Average index houses 30 large, highly traded companies that operate across a wide variety of industries, which makes it a strong starting point for investors seeking dependable category leaders.

With that in mind, a panel of Motley Fool contributors has identified Apple (NASDAQ:AAPL), Merck (NYSE:MRK), and Caterpillar (NYSE:CAT) as top Dow Jones stocks to buy right now. Read on to see why they think that these companies have what it takes to be market-beating winners.

Image source: Getty Images.

Apple is a blue chip tech leader that still breaks the mold

Keith Noonan (Apple): If you're concerned that market volatility is on the horizon, it's generally a good idea to avoid growth-dependent tech stocks. Apple is posting strong sales and earnings growth, but the stock has also recently climbed to new highs, which may raise some concerns. It already stands as one of the world's largest companies, and investors may be wondering how much room for expansion is still on the table.

So, what makes the company a great buy now in spite of all these characteristics? Last year, Warren Buffett had this to say about Apple: "It's probably the best business I know in the world." That's strong praise from such a legendary investor, and it's not hard to see why he thinks that the tech giant is on track to serve up more big wins.

Apple commands incredible loyalty among its customer base, and it will likely continue to thrive as technology comes to play an increasingly important role in business and everyday life. The company also looks well positioned to benefit from powerful tech trends that are primed to play a huge role in shaping the next decade.

Looking for a pick-and-shovel play to benefit from the growth of augmented reality? Apple is one of the best bets you can make. The tech leader is also set to play a huge role in shaping the evolution of 5G mobile hardware and software, with dramatically improved upload and download speeds paving the way for a wide range of new applications.

Is Apple stock primed for explosive growth going forward? The company's already massive size suggests that big share price jumps will be harder to deliver going forward. However, there's a great business here and an appealing risk-reward dynamic, and it's likely that investors will still be able to notch market-beating returns with this blue chip tech giant.

This is still Merck, the powerhouse pharma company

James Brumley (Merck): It's curious. While the overall market's performed incredibly well since hitting bottom in March of last year, Merck has largely been left out of that effort. And I get why. Not only was it never a real contender in the race to develop the first COVID-19 vaccine, the past year and a half has dramatically favored growth stocks over value names. Merck of course is the latter, and subsequently down around 5% for the past year, one of only three Dow names in the red for the past 12 months.

I suspect, however, we're entering a period that finally rewards value at the expense of growth. That clearly works in Merck's favor.

Perhaps the best argument for stepping into Merck sooner rather than later, however, is simply that this is still Merck regardless of the stock's relatively tepid performance of late. While it may not be much of a player in terms of the initial answers to COVID-19, this is the same company behind blockbuster drug franchises like Keytruda, Gardasil, and diabetes treatment Januvia, just to name a few. These are stalwart products that set the stage for years of reliable revenue.

And here's the kicker: Although it's not been particularly well covered by the media, Merck's orally administered molnupiravir is now in trials as a treatment for COVID-19 infections. If you think the infectious disease is here to stay (as many people do), broad therapies rather than highly targeted vaccines may actually be the bigger opportunity.

The coiled spring

Daniel Foelber (Caterpillar): Few stocks embody the effects of baked-in expectations better than Caterpillar. The international equipment manufacturer saw its sales and earnings plummet in 2020, but its stock price beat the market. The preemptive share price increase had to do with expectations that Caterpillar would be an obvious winner from a coronavirus vaccine. It was.

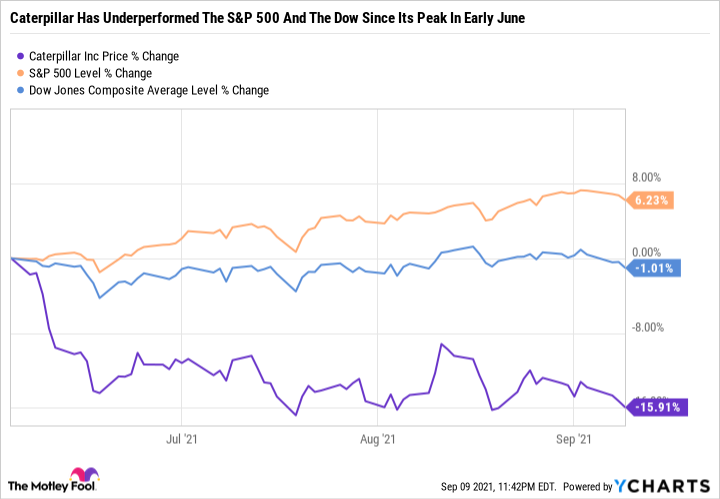

This year's economic recovery, strong oil and gas prices, and a booming construction market have helped Caterpillar return to growth. Its stock price followed suit, as Caterpillar was one of the best performers in the Dow until early June.

However, the last few months have seen a sizable decline in Caterpillar's stock price despite a gain in the S&P 500 and Dow. With just a couple of quarters of excellent results, Caterpillar still has to prove it's in for a sustained cyclical boom to regain Wall Street's favor. The last upcycle was interrupted by the U.S.-China trade war, something that Caterpillar was vulnerable to given its large position in China. Even during the worst of the pandemic, one of Caterpillar's few bright spots was its growth in the Asia-Pacific region. If Caterpillar can combine its success in Asia with a rebound in North America and South America, it could unleash a coiled spring of multiyear growth.

Even though it's out of favor, there are many reasons why Caterpillar is a great stock to buy now. The company has improved the strength of its balance sheet, making it resilient to market cycles. It's also a Dividend Aristocrat, having raised its dividend for over 25 consecutive years. Caterpillar's 2.2% dividend yield may not be the highest of the Dow components. But when you combine the company's upside and industry-leading position with a steady income stream, the investment thesis for owning the stock becomes more attractive.

This article represents the opinion of the writer, who may disagree with the “official” recommendation position of a Motley Fool premium advisory service. We’re motley! Questioning an investing thesis -- even one of our own -- helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.

"right" - Google News

September 12, 2021 at 06:15PM

https://ift.tt/3tylZRY

3 Dow Jones Stocks to Buy Hand Over Fist Right Now - Motley Fool

"right" - Google News

https://ift.tt/32Okh02

Bagikan Berita Ini

0 Response to "3 Dow Jones Stocks to Buy Hand Over Fist Right Now - Motley Fool"

Post a Comment