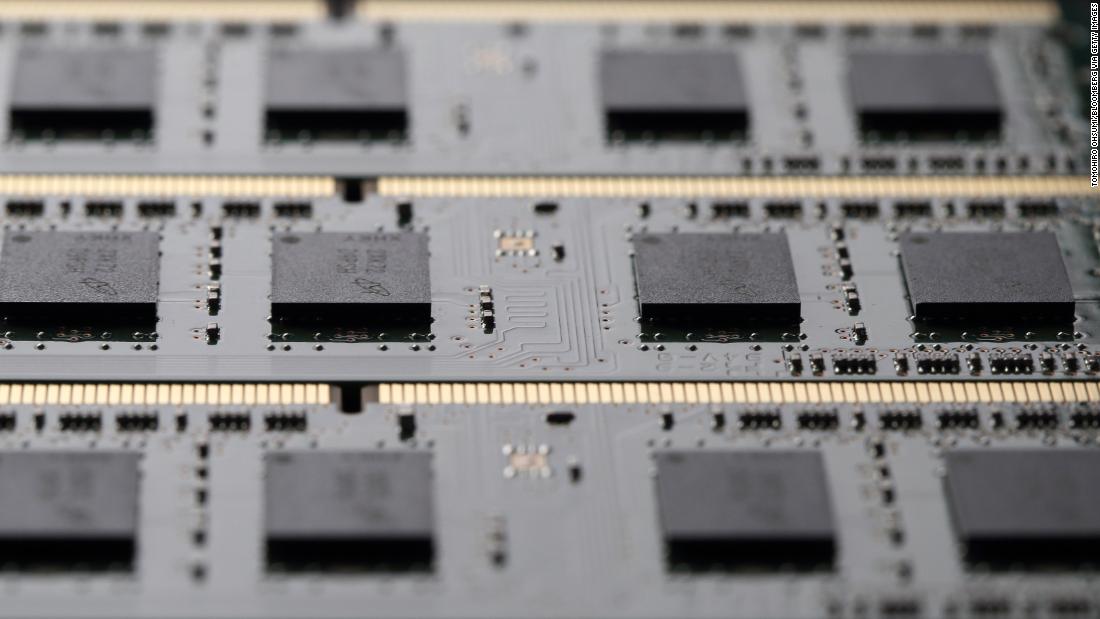

Micron, which is based in Idaho, said it conducted a legal review of its relationship with Huawei after a US export ban targeting the company was announced last month.

The chipmaker has determined that it can "lawfully resume shipping a subset of current products" that were not subject to American restrictions.

Even so, CEO Sanjay Mehrotra warned of "ongoing uncertainty" that could affect the business relationship, underlining the questions that currently face US tech companies that rely on the Chinese market.

"We cannot predict whether additional government actions may further impact our ability to ship to Huawei," he said.

Micron's earnings report showed that its quarterly revenue fell to $4.8 billion from $7.8 billion, but that still topped analysts' expectations.

2. Central bank buzz: Central bankers are in the spotlight after a speech from Federal Reserve Chair Jerome Powell undermined market confidence that an interest rate cut in July is all but certain.

Powell stressed Tuesday that policymakers would carefully monitor economic developments but warned they "should not overreact" to a single event in deciding whether or not to cut rates.

The nation's central bankers are "grappling" with whether rising trade tensions, softness in the global economy and signs of muted inflation will continue to weigh on the American economy, Powell said.

His remarks spooked investors, sending the Dow and S&P 500 to their worst one-day percentage drop since May 31.

Attention now shifts to Bank of England Governor Mark Carney, who testifies Wednesday before Parliament. The United Kingdom still has big questions to answer about its plans for Brexit.

3. Markets mixed: US stock futures point slightly higher after Tuesday's drop-off.

The Dow is set to open flat, while the Nasdaq and S&P 500 are tracking up 0.1%.

European markets were mixed in early trading. Britain's FTSE 100 fell 0.1%, while Germany's DAX posted a small gain.

Stocks in Asia, meanwhile, mimicked US declines. Hong Kong's Hang Seng dropped 1.2%. Japan's Nikkei shed 0.4%.

On the radar are US durable good orders for May and the latest on US oil inventories. US crude futures are up 1.9% after American Petroleum Institute data indicated a surprisingly large decline in supply.

https://www.cnn.com/2019/06/26/investing/premarket-stocks-trading/index.html

2019-06-26 11:06:00Z

52780321455151

Bagikan Berita Ini

0 Response to "Micron surge; Central banker buzz; Crude data - CNN"

Post a Comment